Insights

Stay up to date with the latest news & insights

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

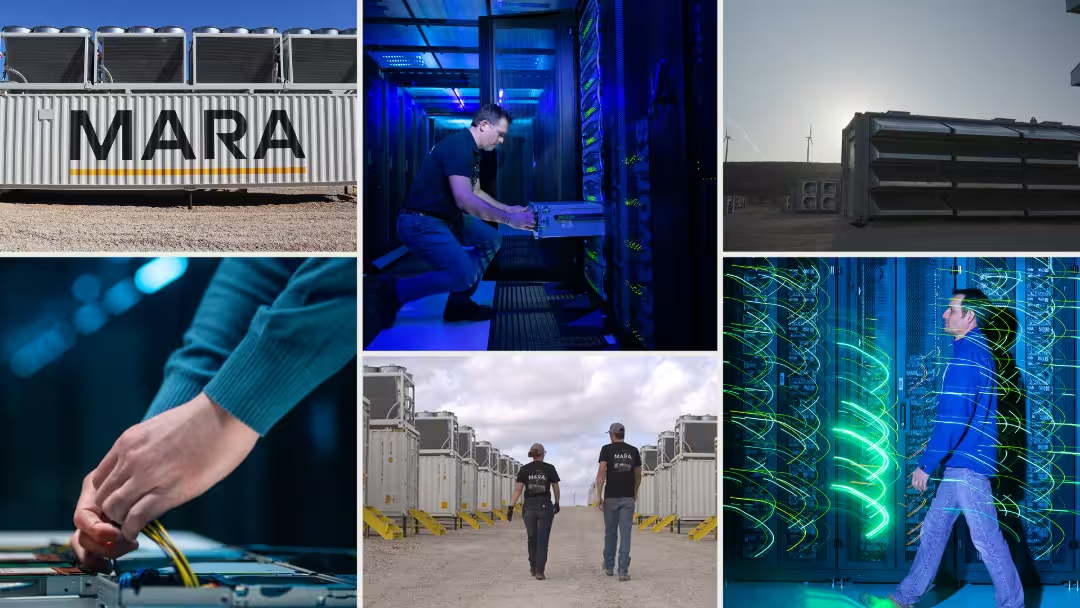

MARA Q4 & Fiscal Year 2025 Earnings Call

What Exaion Means for MARA & the Future of AI in Europe

Announcement

EDF Pulse Ventures Partners with MARA & NJJ to Support a New Phase of Exaion’s Development

EDF Pulse Ventures Partners with MARA & NJJ to Support a New Phase of Exaion’s Development

Case Study: Balancing the Grid During Winter Storm Fern

Bitcoin & the Quantum Question: What You Need to Know

Blog

The Future of Artificial Intelligence: Energy Generation Is Only Part of the Story

The Future of Artificial Intelligence: Energy Generation Is Only Part of the Story